Accountants can optionally reverse adjustments at the beginning of an accounting period if a portion of the service, or the receipt of the bill for a service, occurs in the period immediately before. This process is similar to the adjustment of asset value using current depreciation. However, unlike operational adjustments, depreciation adjustments are never reversed since they do not reflect a revenue or expense item incurred during two periods, or an accrual over two periods.

Accrual Basis of Accounting

In accrual accounting, transactions must be recognized in the financial statements when they occur — not when invoices are issued or cash is transferred. For example, revenue must be recorded when the service or product is delivered, and expenses must be recorded either when the correspondent revenue is earned (as with variable costs, aka Cost of Sales) or when the expense is incurred (for example rent of the month).

At the same time, accountants need documentation to enter the correct amount of the revenue or expense. In nearly all cases, this documentation is an invoice, or bill.

However, what happens if an invoice isn’t issued, but the revenue or expense has been incurred? Moreover, what happens if an invoice is issued up-front for a service revenue that occurs over time, or for an expense that’s incurred over more than one month (insurance premiums, for example)? In these cases, we need adjustments.

Adjusting Entries

Adjusting entries allow an accountant to record a revenue or expense (or portion thereof) in the period it is incurred, even if he/she lacks documentation.

Two cases exists: an accountant must:

- enter placeholders when an item is incurred but no invoice exists yet, or

- he/she must prolong the recording of a revenue or expenses if it represents a service delivered over time.

A third adjustment is depreciation. It requires adjustments made over time as well, since only portions of a long-term asset’s cost can be recorded in each accounting period.

Reversals

Some adjustments need to be reversed. For example, when a company incurs an expense at the end of an accounting period but has not received an invoice, it must record this as “accrued expenses” on the P&L and as “accrued liability” on the balance sheet. In the beginning of the next accounting period, they “reverse” this adjustment to reflect the arrival of the invoice in accounts payable or in cash withdrawal.

We’ll look at more in-depth examples below, but it’s important to note that not all adjustments can be reversed. Only those that involve the profit and loss statement and concern items covering two periods can be reversed!

Reversing Entry for Depreciation Expense

Importantly, depreciation expenses are never reversed. This is because depreciation adjustments do not concern items covering two periods. Other example of adjustments that cannot be reversed are those that record the correct portion of a receivable or payable amount in the accounting period, even if the invoice is not received.

Specifically, only accrued revenue and accrued expenses are reversible entries. In addition, deferred revenues and deferred expenses can be reversed if they are recorded on the profit and loss statement, but not if they’re directly recorded as cash and liabilities or assets.

Accrued Revenues Adjustments & Reversals

Imagine you own a wholesale watch company. You deliver watches to one of your customers on December 22nd worth $500. However, you are not able to issue the relevant invoice to the client until January. Under the accrual basis of accounting, you still need to record this sale in December.

Adjustment

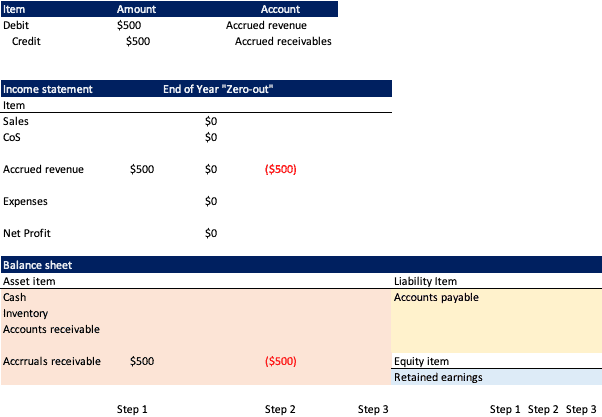

To record the sale, you will enter the following entry on your books:

We record the revenue on P&L as a special accrued revenue, and include it as an asset on the balance sheet.

Reversal

The trouble here is that we haven’t actually sent the invoice documentation in December. To fix this we will record a reversal in January (then book the receivable once the invoice is issued).

Importantly, these transactions will have no net impact on the revenue in January. This is because the P&L accounts are “zeroed-out” at the end of an accounting period. The reversal entry will thus negate our balance sheet amount, and create a negative value under revenue. Here’s how it looks:

Once we issue the invoice for this revenue in January, we can record the accruals as an account receivable and a normal revenue. This results in a net “0” amount in January on the P&L, and the correct $500 receivable on the balance sheet:

Accrued Expense Adjustments & Reversals

Accrued expenses are costs our company has incurred but for which we have not yet received an invoice. They operate very similarly to accrued revenue.

Imagine, for example, that we will receive the invoice for three months of rent ($300) from October 1st, 20X1 – December 31st, 20X1 on January 15th, 20X2. We incur the cost of rent in 20X1, but don’t have an invoice until the following year.

In this case, we need to record an adjustment for the accrued expense on the P&L and a accrued rent liability on the balance sheet. However, we will need to reverse this in January in order to account for the arrival of the invoice. Then we will properly book the expense on the Balance sheet in January as accounts payable.

Adjustments and Reversals

It happens in three steps, as demonstrated in this picture:

The result is that we correctly record revenue in 20X1, and we note the correct payable in January 20X2.

Deferred Revenue Adjustments & Reversals

Deferred revenue is the opposite of accrued revenue. It consists of money the company receives before it has delivered a service. Under the accrual basis of accounting, only revenues that have been incurred should be recorded on the P&L. This means the company has a liability — an obligation to perform a service or deliver a good in the future.

Importantly, cash receipts are the catalyzing event for deferred revenue, not invoices. Whether we issue the invoice for the service or not, it’s the receipt of money and non-performance of the service (or product) that creates the obligation on our balance sheet.

Adjustments of deferred revenues, therefore, do not consist of corrections upon the receipt of an invoice, but the partial delivery of a service over time.

Imagine that our watch company receives an up-front payment in June 20X1 for $500 of watches that will be delivered over the course of the following 5 months from July – November in installments of $100 per month.

The first step is to record the cash receipt as a liability:

Now that we’ve “loaded up” the balance sheet liabilities with this deferred revenue, we need to show the revenue earned over time on the balance sheet. Let’s jump forward to July, where we deliver the first $100 worth of watches to our client. It will look like this:

At this point, we’ve made our adjustment and we’ve completed the steps. However, we have not performed a reversal. That’s because our adjustments do not modify an amount on the profit and loss statement. Indeed, it is never possible to perform a reversal on deferred revenue recorded as a liability up front.

The only way we would perform a reversal on deferred revenue is if we first record the entire amount as revenue up-front. Let’s look at how this plays out.

The Alternative Income Method for Deferred Revenue

The income method of adjusting and reversing deferred revenue begins by recording the full amount in period one as a revenue, then adjusting it over time as revenue is earned.

Using the same example from above, let’s look at how we would recognize $500 in revenue delivered over 5 months. Using the income method, it would look like the following:

Thereafter, the adjustment consists of moving the unperformed portion of the revenue to a liability account, in this case deferred revenue. In our case, this amount will be $400 in July, since we earn $100 immediately that month. It looks like this on the books:

As you can see, we now have a net revenue value of $100 at the end of July. This is correct. However, were this the end of an accounting period and we planned to enter the full value of the deferred revenue invoice in the following year, we would need to reverse both steps 1 and 2 above, allowing us to correctly book the cash value of $500 in both accounting periods, as well as the $100 revenue in period one and the $400 in period two…

This may sound complicated, and it is. Very few accountants would use the income method to record a deferred revenue, so don’t worry about this showing up in practice. I mention it here to give a full picture of the possibilities of adjustments and reversals, but it’s very rare.

Deferred Expense Adjustments & Reversals

Deferred expenses are the opposite of accrued expenses. They consist of expenses paid for but not yet incurred. The most common example of a deferred expense is insurance premiums. A company pays an insurance premium at the beginning of the year for coverage throughout that year, but does not actually incur the coverage until the relevant month arrives.

In this case, the same booking steps used in deferred revenues apply. The company may record the transaction either immediately on the balance sheet as a deferred asset, or fully on the income statement as an expense that’s adjusted over time. As with deferred revenues, the balance sheet method is by far more common than the P&L method.

Depreciation Adjustments & Reversals

Depreciation is an adjustment unlike the others discussed in this article. Whereas accrued revenues and expenses concern corrections on the P&L, and deferred revenues and expenses concern the adjustment of values incurred over time, depreciation is a special adjustment that records the expense of a big asset over several accounting periods.

A large asset such as a watch-making machine must be purchased up front. However, the asset is “used” over time, usually multiple years. In this case, the accrual method of accounting requires that we record this expense over time. Depreciation is the periodic recognition of the asset over time. It is recorded at fixed amounts throughout the life of the loan, and it is never reversed. Why? Because the current depreciation transaction itself does not span two accounting periods.