There’s a blurred line between “personal” and “business” financial management software (FMS). Understanding this will help you make a good choice.

Most entrepreneurs run sole proprietorships or disregarded LLCs, so business and personal expenses like gas and phone get mixed together. You could use two apps, but shouldn’t your financial management software support the way you operate?

And if you’re an individual, there’s no reason to pay more for business functionality.

That in mind, in this guide I rank and review the 27 best financial management software, as well as our top 3 picks, so you can choose the best one for your situation.

Best for Beginners

Quicken

Base Price: 30-day free trial

Premium Price: $35.88/yr

# of Core Features: 4

Best for Entrepreneurs

Bonsai

Base Price: 7-day free trial

Premium Price: $384/yr

# of Core Features: 6

There’s a lot to consider, but we break it down into 9 core functionalities, price, and device compatibility. These 13 criteria constitute our score:

- Devices (mobile and/or desktop)

- Free plan/trial

- Premium pricing

- # of users

- Net-worth calculator

- Brokerage account linking

- Bank account linking (personal and business)

- Budgeting

- Reporting

- Project management module

- CRM module

- Debit card

- Credit card

Financial Management is Hard

Financial management can tough. A friend of mine tells the story of how his business failed due to a lack of oversight.

He trusted bookkeeping to a family member who embezzled money for years. Eventually he found out and got rid of the guy. But trust issues started sneaking up on him.

He became obsessed with reviewing all his accounts, which ate up his time. He couldn’t see red flags popping up around customer service, and the company’s biggest recurring client ended up leaving, and the loss forced him shut down.

“It was embarrassing,” he says. “I felt like it was my fault that someone stole from me. I didn’t realize it at the time, but it just got to me. I wanted to review everything. I didn’t want that to happen again.”

The whole ordeal took about 4 months.

And it could have been avoided with a good FMS.

He would have seen the embezzlement early on, and even if not, the software would have raised red flags around smaller client billings. Moral of the story: hire good people, and invest in a darn good FMS.

Some FMS are more sophisticated than others, but once you have an overview of their functionalities the choice will be easier. And you won’t pay extra for functionalities you don’t need.

What does financial management software do?

FMS combine data from all your accounts so you can analyze historical figures and forecast future results. They combine tracking, budgeting, planning, and consolidation tools in one place. They can link to accounting software and provide tax reporting services, as well as project management and CRM software.

What software do financial managers use?

In bigger companies (say, more than 50 employees), financial managers use enterprise resource planning (ERPs), database management systems, big data visualization tools, and good ol’ Microsoft Office.

The truth is you don’t need all those systems.

They are SUPER powerful. ERPs can handle terabytes upon terabytes of data from all different departments. Database management systems are virtually limitless but require a data engineer to maintain. Financial managers use visualization tools like Tableau and PowerBI to access all those figures. Then Microsoft Office comes into play so everyone can participate.

But you can stay lean with a simple accounting software, your bank accounts, and a financial management software solution (and MS Office).

Is Excel a financial management system?

Its the elephant in the room, but the answer is no. Excel is not a financial management system because it doesn’t use fixed parameters to summarize data from multiple linked sources within a protected closed system.

You can’t open Excel online and use it like an app; it’s spreadsheet software, not an FMS.

In theory you could create an automated workflow to produce the same results… but it would probably have compatibility issues and require manual maintenance. It definitely wouldn’t be a secured closed system. In short, don’t use Excel as an FMS.

OK, but what is it exactly?

In short, Financial Management Software is a web or mobile application. It summarizes all your financial data in a 1 – 3 dashboards. It links to bank and loan accounts, accounting software, and investment accounts to collect data, and lets you enter personal assets like jewelry to fill the gaps.

It will make more sense with examples below.

What’s the best financial management software?

Here are our top picks:

Note: inverted price axis (Y) for readability

#1 Quicken Simplifi

Best for Beginners

The Bottom Line

I didn’t expect a paid option like Quicken to come out on top, but it’s one of few solutions that pulls out all the stops. It connects to any of your bank and investment brokerage accounts so you don’t have to enter manual transactions. The budgeting feature is super easy to use, and the visual reports are easy to understand.

One cool thing is Quicken Premier provides tax optimization solutions and a desktop app, so you can try Simplifi for yourself and upgrade as needed. Many people do.

Take note that Quicken won’t provide a debit or credit card so it’s not a full “banking” FMS. For that, we recommend Bonsai.

Our rating: 9.18/10

Key Features

There’s no free version past the 30-day trial, but at ~$35/year Quicken is among the quarter most affordable options on our list. It’s user count is in the 81st percentile, which means a lot of other people are using it.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 30 day trial | $35.88/yr | 81% |

Full Features

This table says it all. There’s no “advanced” features such as PM, a CRM, or cards, but anyone who just wants to try out an FMS will find Quicken’s basic functionalities very easy to use.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#2 Bonsai

Best for Entrepreneurs

The Bottom Line

Bonsai is the sweet spot between personal and business FMS. It’s designed for entrepreneurs and helps you open a dedicated bank account that links directly into the app. A debit card comes with it, and you’ll be able to categorize income and expenses in a way that makes sense. For most freelance or service business owners income buckets aren’t all that useful but expense management is great.

One cool thing is its project management and client management modules. They eliminate the need for multiple software. For $32 per month, it’s pretty reasonable.

Take note, however, that Bonsai does NOT integrate other banking accounts into one view. It’s a closed system, so if you want a more “portfolio” style solution, we recommend Empower.

Our rating: 9.17/10

Key Features

I definitely recommend doing the 7 day trial because it’ll help you decide whether Bonsai has the stuff you need. Just be open because it’s a one-of-a-kind solution and may take some getting used to. At $32 per month, it’s inexpensive for FMS/CRM/PM tools, but it’s also the most expensive option on our list.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 7 day free trial | $384.00/yr | 92% |

Full Features

The key takeaway in this table is that Bonsai provides a bank account directly through its platform. You cannot connect other accounts for tracking purposes. This isn’t a big problem for most, but bank shoppers may want more flexibility.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | No, native account |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | Yes |

| CRM: | Yes |

| Debit Card: | No |

| Credit Card: | No |

#3 Empower (Personal Capital)

Best Free FMS

The Bottom Line

Empower is a very flexible FMS. It was also on our list of portfolio management software because it can frankly be used for both. Connect any bank or brokerage account, add personal and business assets, plug in your business or personal loans, and see your net worth.

The best part? It’s free.

Our rating: 9.16/10

Key Features

You can get started with Empower today because it’s absolutely free.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $0.00/yr | 62% |

Full Features

It’s not perfect though. It’s heavily focused on the financial management part, so it doesn’t do other workflows like Bonsai.

| Net-Worth Calculator: | Yes |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#4 StatusMoney

Best for Peer Comparison

Our rating: 9.16/10

The Bottom Line

Status lets you track your finances and compare with peers. Done well, you can get a lot of perspective on how your run your business and your life. It’s almost like a small form of market research, but done every time your check your finances.

Key Features

The basic functionalities are free, but if you want to to unlock detailed tracking for your spending, income and other accounts you’ll need the premium version.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $240.00/yr | 85% |

Full Features

Status is pretty comprehensive. Except for project management and CRM modules and a debit card, it has all the core features.

| Net-Worth Calculator: | Yes |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | Yes |

#5 MoneyWiz

Best for “Slicing & Dicing” Transactions

Our rating: 9.13/10

The Bottom Line

I’m a big fan of MoneyWiz, and I wish the development teams could produce updates as fast as Apple.. The initial design and functionalities across desktop and mobile apps is unique to just a few FMS, MoneyWiz included. The accounts, budgets, statistics and reports are all neatly organized with intuitive icons, and you can add tags and categories to customize the app.

The major downside is UX. The apple is just outdated. It works fine and is 100% secure, but the charts aren’t as useful anymore.

Key Features

Part of the reason it’s become slightly outdated is the free pricing structure. You get most of the functionalities free, so the premium account attracts fewer users and MoneyWiz has less cash to improve.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $49.99/yr | 27% |

Full Features

Though flexible as an FMS, MoneyWiz doesn’t have ERP-style functionalities such as PM and CRM tools.

| Net-Worth Calculator: | Yes |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#6 Banktivity

Best for Transaction-level Tracking

Our rating: 9.10/10

The Bottom Line

For Mac users who want a LOT of control over their asset tracking, Banktivity is a strong candidate for your business. It has built-in ROI and IRR calculations for your investing activities, as well as good ol’ fashion bank account inflows and outflows. You can connect to whatever accounts you want, tracking both your business and personal assets.

Key Features

Everybody likes a free tool, but the advantage of using a paid solution is the continued quality and updates you’ll get. For just under $70 per year, it’s not a bad deal.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 30 day trial | $69.99/yr | 15% |

Full Features

One feature we would expect to see is a net-worth tracker. Banktivity has a “total value” alternative which essentially serves the same purpose, but you have to dig for it. Not the end of the world, but could be better.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#7 CountAbout

Best for Solo Entrepreneurs

Our rating: 9.07/10

The Bottom Line

Don’t expect much by way of user experience with CountAbout. It’s definitely not a “modern” FMS. That said, it tracks transactions in a debit/credit accounting format, which is extremely useful for users who want to use it as a “mini ERP” for solo businesses.

Key Features

CountAbout has a 45 day free trial, which seems random until you consider 45 days allow for a typically month-end close. It just reinforces who they’re targeting — accounting savvy solopreneurs. After you test a month, it’s only $39.99 per year.

| Devices | Base Price | Premium Price | User # Rank |

| App | 45 day trial | $39.99/yr | 8% |

Full Features

No net-worth calculator and limited non-financial modules are available. But it’s very effective for investment, asset, and bank account tracking.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#8 YNAB (You Need A Budget)

Best for Budgeting

Our rating: 9.06/10

The Bottom Line

YNAB targets personal finance. It provides buckets for your budgeting needs so you don’t overspend. But this approach can be easily applied to a small business as well. A lot of research suggest cash flow is the #1 cause of small business failure. If you categorize and schedule all your payments in YNAB, you can avoid the trouble entirely.

Key Features

After your 34 day trial (don’t ask me why it’s 34 days…), you’ll pay $8.25 per month, or $99 for the year.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 34 day free trial | $99.00/yr | 65% |

Full Features

One thing to note is investment accounts can’t be linked to YNAB. Most small businesses won’t have marketable securities in brokerage accounts, but if you do, or if you want to combine your personal accounts, it may not be the right choice.

| Net-Worth Calculator: | Yes |

| Investment Consolidation: | No |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#9 Intuit Mint

Best for Ease of Use

Our rating: 9.05/10

The Bottom Line

Mint is by far the most popular personal finance app out there. It has a free version but the functionality is so limited that you’ll end up paying the measly $12 per year. It’s super easy to use and has strong support, though the constant dual authentication can be a bit frustrating.

Key Features

Mint’s user count is in the 96th percentile on our list.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $11.88/yr | 96% |

Full Features

Despite its awesome interface, Mint lacks several key functions, including a net worth calculator. It’s also a bit confusing because Mint offers brokerage accounts, but only through partners that they try to upsell you on.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No, but has partnerships |

#10 Yotta

Best for Prizes

Our rating: 9.01/10

The Bottom Line

Yotta is a savings account with lottery-style prizes instead of basic low <0.003 interest. It’s essentially a way to play the lottery without buying a ticket, just by having your money in an account. That said, it only allows personal accounts, so you’ll have to connect this account with another FMS for business purposes.

Key Features

Yotta is 100% free.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $0.00/yr | 77% |

Full Features

Yotta functionalities are a bit limited because its focus is prize-linked savings accounts, but you can supplement with a debit and credit card.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | No |

| Budgeting: | Yes, “Buckets” |

| Reporting: | No |

| Project Management: | No |

| CRM: | No |

| Debit Card: | Yes |

| Credit Card: | Yes |

#11 Honeydue

Best for Couples

Our rating: 8.96/10

The Bottom Line

HoneyDue is a joint account for couples with a connected app to help them manage finances together. Like Yotta, it’s not a business account, but if you want to link it through another FMS for viewing purposes, you can.

Key Features

HoneyDue operates on a “tip” system, where you can compensate the app when you feel the service is good.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | Tip-based | 42% |

Full Features

It has all the core linking functionalities with bank and investment accounts, as well as a debit card. Note, however, that it is missing a net-worth calculator.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | Yes |

| Credit Card: | No |

#12 MoneyDance

Best for One-Time Purchase

Our rating: 8.95/10

The Bottom Line

MoneyDance is a good hands-on solution with lots of account linking and reporting, but it lacks project management, CRM, and most importantly, a budgeting feature.

Key Features

You won’t want to enter manual transactions for very long, so expect to pay the premium ˜$50 per year.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free (manual transactions only) | $49.99/yr | 19% |

Full Features

The real value proposition with MoneyDance is flexible analysis down to the transaction level. It doesn’t have some of the more user friendly functionalities such as a net-worth calculator or budget module.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#13 Stock Rover

Best for Advanced Investors

Our rating: 8.93/10

The Bottom Line

I’m a big fan of stock rover, but as an FMS it’s only useful for investment analysis. You can use it for your business’ marketable securities if you have any.

Key Features

Most of the core functionalities are free, but if you want to extensive research reports and spreadsheet export functionality, you’ll need to premium service at $160 per year.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $160.00/yr | 100% |

Full Features

Stock Rover only has 2 of 9 core functionalities, but it does them extremely well. If investment analysis and reporting is important to you, Stock Rover is the way to go.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#14 EveryDollar

Best for Coaching Built-In

Our rating: 8.87/10

The Bottom Line

EveryDollar is the app-extension of Ramsey solutions, one of the oldest schools of thought in personal money management. It’s a good choice for those who want advice and coaching.

Key Features

At ~$80 per year, Ramsey is more expensive than about half of this list.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $79.99/yr | 69% |

Full Features

There’s no net worth calculator built in, but you can always use the free one online. There’s no investment account consolidation, so be sure you’re mainly interested in personal cash flow management.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#15 GoodBudget

Best for “Envelope” Method

Our rating: 8.85/10

The Bottom Line

GoodBudget is a cool way to pre-treat your income to avoid over spending. It’s competitive with EveryDollar but hasn’t picked up enough users yet for us to rank it higher. On paper, it’s a more affordable alternative.

Key Features

As with most app, you can get a feel for the interface with free access, but you’ll need to pay for most critical features.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $70.00/yr | 54% |

Full Features

Features are limited to bank linking, budgeting, and reporting, so this is not a Stock Rover or Bonsai alternative.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

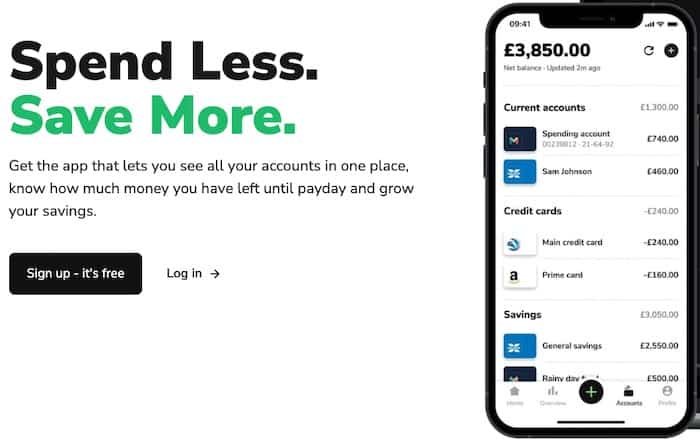

#16 Money Dashboard

Best for UK Citizens

Our rating: 8.84/10

The Bottom Line

We primarily write to an American audience, but Money Dashboard is an exception. It’s a very good budgeting app for UK residents.

Key Features

The cool part is it’s free. That said, MoneyDashboard sells your anonymized data to make money. It can’t be linked to you, but not everyone is comfortable selling their behavior.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $0.00/yr | 31% |

Full Features

Money Dashboard is nice, but like EveryDollar and GoodBudget it’s not a comprehensive FMS. Individuals who want help managing their budget will get the most from it.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | Yes |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#17 Kubera

Best for High-Net-Worth Individuals

Our rating: 8.83/10

The Bottom Line

Kubera does one thing better than any other: asset variety. You can plug in cars, jewelry, art, even domain names, in addition to bank and brokerage accounts. It claims to be the FMS for high-net-worth individuals, and we agree.

Key Features

There is one significant issue with Kubera. You can’t download the app in the app store. Instead, you have to access the website via Safari on your iPhone, then download it from there. Not very user friendly.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 14 days for $1 | $150.00/yr | 0% |

Full Features

Kubera doesn’t provide cards, and it doesn’t have PM or CRM functionalities, but it does pretty much everything else.

| Net-Worth Calculator: | Yes |

| Investment Consolidation: | Yes |

| Bank Consolidation: | Yes |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#18 getquin

Best for Forum

Our rating: 8.80/10

The Bottom Line

getquin is primarily a portfolio tracker, which makes it useful for companies with marketable securities on their balance sheet via a brokerage account. For anyone else, this is probably not the right solution.

Key Features

getquin is relatively new, so there aren’t a lot of users. But you can test the free version, and upgrade for only $38 per year afterward.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $38.99/yr | 4% |

Full Features

To be clear, getquin is a brokerage tracking and reporting app, so it’s not the right option for someone who wants to track their banking activity in detail — personal or business.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#19 Albert

Best for Small Advance ($250)

Our rating: 8.80/10

The Bottom Line

Albert’s slogan says it all, “the simple way to bank, save and invest.” It provides a small advance on pay of $250 for those in a bind and otherwise provides all the typical functionalities of a bank account, accessible easily from the app.

Key Features

Albert’s basic functionalities in the free version are more than enough to get started, but to use the “genius” function and get advice from professionals, it’ll cost $96 per year.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $96.00/yr | 73% |

Full Features

Albert doesn’t do brokerage and bank account consolidation because it creates new accounts for you natively in the app.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No, only native account |

| Bank Consolidation: | No |

| Budgeting: | Yes |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | Yes |

| Credit Card: | No |

#20 Delta

Best for Fast Updates

Our rating: 8.69/10

The Bottom Line

Delta is one of the more modern options on our list. It has regular updates, a great interface, and it’s super easy to use. BUT, it’s not a full FMS. You can only link brokerage accounts, so this is another example of an option for individuals who want a portfolio manager or businesses with security assets.

Key Features

If you want unlimited brokerage connections and automated insights, go with the premium subscription. Otherwise a free account should do the trick. Delta is gaining traction, with more users than about half of the others on our list.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $58.99/yr | 46% |

Full Features

A few minutes on the app and you’ll wonder why we don’t rank Delta higher. The issue is it’s a bit limited in terms of functionality. No PM, CRM, or bank account linking. It only has investments and reporting.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#21 Stock Events Portfolio Tracker

Best for Key Event Tracking

Our rating: 8.66/10

The Bottom Line

For stock, ETF, crypto, and commodity tracking, Stock Events provides a simple, cost-effective solution. Most functionalities are available free, but if you want unlimited watchlists and stocks on them, or information about upcoming IPOs, you’ll need the premium subscription at $29.99 per year.

Key Features

Stock Events doesn’t have the coolest name, but it has more users than about a quarter of the others on our list, which speaks to its utility.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $29.99/yr | 23% |

Full Features

Like others rated lower on our list, Stock Events only has investment account consolidation and reporting. That begs the question of why choose it over a more sophisticated solution like Stock Rover. The main reason is usability. Stock Events has a much nicer interface, which counts for a lot with some users. Personally I prefer Stock Rover, but I’m an active investor.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#22 MorningStar

Best for Deep Market Analytics

Our rating: 8.63/10

The Bottom Line

Most people know MorningStar for its use as a professional-grade market analytics tool, but few know about the retail investor solution. The reality is this app isn’t a great FMS for an average user. It targets experienced investors and business people who want to dive deep into securities analysis.

Key Features

After your 7-day free trial, MorninStar will run you $249 per year.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | 7 day free trial | $249.00/yr | 38% |

Full Features

Like Stock Rover, MorningStar focuses on investment consolidation and reporting. It lacks operational modules and card services.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#23 CoinTracker

Best for Overall Crypto

Our rating: 8.61/10

The Bottom Line

CoinTracker is an FMS for crypto assets. It links to different wallets and centralizes performance reporting in one place. It’s ideal for individuals and businesses that own crypto assets.

Key Features

If you want to track your performance over time (which almost any good investor will), you’ll need the premium plan. Otherwise, go free for current value reporting.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $168.00/yr | 50% |

Full Features

Another one for the active investor, CryptoTracker focuses on consolidating and reporting one asset class, digital currencies.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#24 Stock Central

Best for Stock Investors

Our rating: 8.54/10

The Bottom Line

Stock Central has a nice, albeit outdated, interface for stock tracking. It’s a good choice for those focused purely on stock tracking in their FMS. Not many do, which is why we rank it so low.

Key Features

The free version has ads, so if you want a cleaner experience you’ll need to get ~$7 per month subscription. It’s more affordable than about 50% of the others on our list.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop & Mobile App | Free | $79.99/yr | 35% |

Full Features

True to its name, Stock Central’s My Stock Portfolio app provides tracking and reporting for stocks only.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Stocks Only |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#25 PocketGuard

Best for Reducing Bills

Our rating: 8.54/10

The Bottom Line

PocketGuard is a budgeting app like others, but it has one cool function: it can help you negotiate your bills to a lower price. This essentially makes it a small accounts payable team within your personal app.

Key Features

Another cool thing is you can buy it outright for $79.99. That means lifetime access for a price that’s more affordable than about half of the others on our list.

| Devices | Base Price | Premium Price | User # Rank |

| App | Free | $79.99 for LIFE | 88% |

Full Features

PocketGuard won’t handle your investments, but it does a darn good job helping you manage bank accounts and expenses.

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | Yes |

| Budgeting: | Yes (and bill reduction) |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#26 Shrimpy

Best for Crypto Analysis

Our rating: 8.46/10

The Bottom Line

Shrimpy is the weaker alternative to CryptoTracker. That said, it can actually trade for you instead of just track your movements. Very noteworthy is a stop loss function you can activate.

Key Features

Stop loss is awesome, but you’ll have to pay $180 per year for the premium subscription to access it.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop | Free | $180.00/yr | 12% |

Full Features

| Net-Worth Calculator: | No |

| Investment Consolidation: | No |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | No |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

#27 Ziggma

Best for Desktop Only Tracker

Our rating: 8.45/10

The Bottom Line

The final FMS on our list is Ziggma. It’s last for one main reason: you can only access it on desktop.

Key Features

Without an app you wouldn’t expect an investment tracker to gain much traction, but Ziggma has more users than almost 60% of others on our list. You can try it for 7 days, then upgrade for just under $90 per year.

| Devices | Base Price | Premium Price | User # Rank |

| Desktop | 7 day free trial | $89.00/yr | 58% |

Full Features

Ziggma only has investment consolidation and reporting features, so it may be too light for entrepreneurs that want a more complete solution.

| Net-Worth Calculator: | No |

| Investment Consolidation: | Yes |

| Bank Consolidation: | No |

| Budgeting: | No |

| Reporting: | Yes |

| Project Management: | No |

| CRM: | No |

| Debit Card: | No |

| Credit Card: | No |

Scoring Methodology

We rate FMS based on qualitative and quantitative features. We assign points to qualitative features based on their importance to a typical FMS user and assign points to quantitative features based their distance to the mean by standard deviation or percentile rank.

But we’re not robots. We test each option to gut check the scoring system so you get a thorough but realistic reference score.

Software to Avoid

There are a few financial management software that we don’t recommend, primarily because they shut down or because they’re going through corporate level M&A, and the future is uncertain.

- Mvelopes. It was sunset in late 2022.

- FutureAdvisor. It was owned by a big asset management company called Black Rock but was sold off to Ritholtz Wealth on May 17, 2023 so the terms are changing.

- Yolt. It was a UK Money Dashboard alternative that was shut down in 2021.

Conclusion

Deciding on an FMS isn’t easy. The best approach is to determine whether you’re primarily interested in a budgeting solution, an investment tracking solution, or both. Clarity around your target will help you choose with confidence and avoid paying for features you don’t need.

At AnalystAnswers.com we review tech and financial products with a data-driven approach so you can use our scores as a reference and make better decisions. We also teach financial and data analytics to help readers succeed in an increasingly digital world. Learn more on our home page (opens in new tab).